Cameron Fisher

Director Changing Places Real Estate

Konrad Bobilak

Director of Investors Prime Real Estate

Stephen McClatchie

Director Loans Australia

This is NOT a Pitch Fest event where speakers will sell their products off stage. In fact there is nothing you can buy over the weekend so you don’t need to bring your credit card…

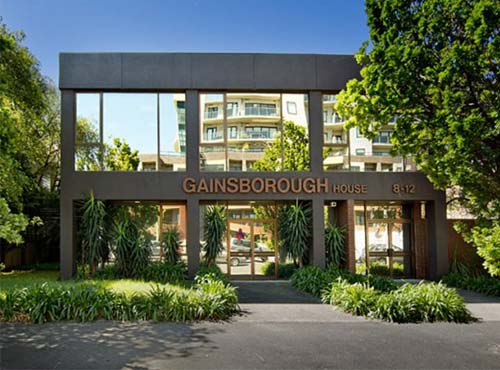

Gainsborough House

Level 1 / 8-12 Alma Rd,

St Kilda VIC 3182

Dates: 8th & 9th November

Sat Registration: 8.30 am

Sat & Sun Start: 9.00 am

Sat & Sun End: 6.30 pm

Cameron Fisher

Director Changing Places Real Estate

Stephen McClatchie

Director Loans Australia

If you’re someone who dreams about owning a large residential Investment Property Portfolio which will enable you to potentially attain Financial Independence then this will be the MOST IMPORTANT letter that you’ll ever read, and the most important 2 day live event that you can attend!

I know that you may be skeptical about this claim, and if you’re anything like me 20 years ago, chances are you’re the person who scratches their head in frustration and wonders how other people seem to make a fortune in the property market, when you’re left out in no man’s land floundering…and that’s why this will be the most important letter you’ll ever read, that will enable you to take advantage of a very unique educational opportunity!

You’re about to discover a PROVEN Step-By-Step Real-Estate Investing System that is easy to follow and makes so much sense I promise you that by the end of reading this letter you’ll be wondering why nobody has told you about it before. In-fact, you’ll be mad at everyone around you that has been putting doubts into your mind about the possibility of you owning millions of dollars in property – I know, like you, I have been there myself.

One thing that I must stress is that this is NOT a get-rich-quick scheme, and I guarantee that you will NOT become a millionaire overnight by following this system.

I am not going to insult your intelligence or make unrealistic claims.

But here is the reality check…

“Bricks and Slaughter”, the 60 Minutes report by journalist Tom Steinfort focused on a “nightmare” scenario outlined by Digital Finance Analytics principal Martin North. It predicted;

“…two-fifths of your home’s worth [would be] wiped out in just 12 months – 40 per cent in a year”…and that was just the beginning…

Now remember, that was back in 2018…it’s now 2025 and for the record we are still waiting for the mythical property market ‘Blood-Bath’ to occur…

In fact;

Even though in 2025 the Australian Residential property market is currently at the very bottom of the property-cycle, it returned an unbelievable 22.4% for the year-on-year just in 2022!

Making their highest annual rate of growth since June 1989, according to CoreLogic.

But let’s remember that old saying that 'the Media will NEVER let the facts get in the way of a good story’.

And the best stories are always negative!

As they say... BAD NEWS SELLS!

No wonder the Australian public, to a large extent, are completely confused, disillusioned and end up sitting on the sidelines…

And I don’t blame them, as it’s very had to work out WHO TO LISTEN TO and WHO TO TRUST, especially when most, so called ‘Academic Experts’, Journalists and even the Banks, keep warning us of the inevitability of the Property Bubble Bursting and the Australian Property Market Crashing!

No wonder the average punter is confused and paralysed! Look, if that’s you, then let me put you at ease...

It seems that the feeling most people get when setting out to buy investment real estate is of disorientation; they feel lost, overwhelmed, apprehensive and scared about throwing their life savings into a large purchase that they have no real idea about (as to whether it is good or bad).

Here are some typical mental “hurdles” that stop people from investing in investment property...

These mental “hurdles” are real, and if not addressed will indeed stop you from building the wealth that you and your family deserve.

Now, here is the scary and eye-opening fact; during all the scaremongering, doom-and-gloom failed predictions, guess what actually happened?

Well nothing! Except that all the broke academics and self-proclaimed property experts got things wrong!

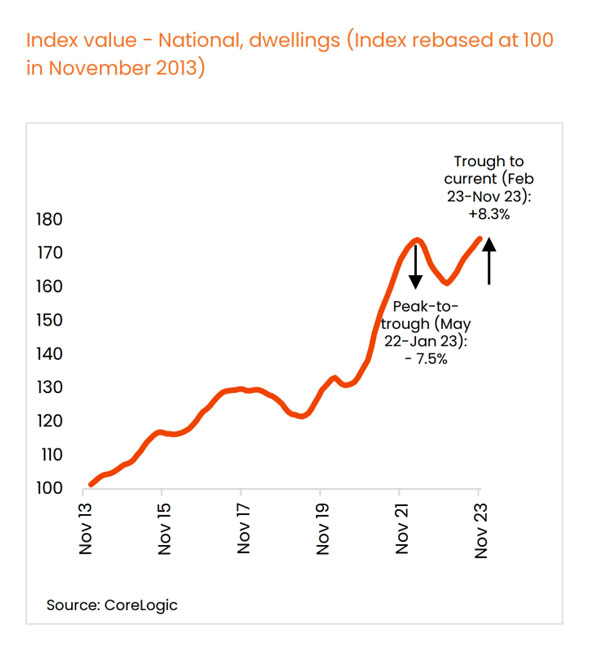

And yes, I must admit that 2023 was a test of resilience for housing values and financial stability more broadly.

The performance of the housing market has been stress tested under the pressure of climbing interest rates, stretched affordability and the transition of many mortgage holders from low fixed rates, to high variable-rate loans.

Home values were not only resilient under these conditions, but reached new record highs.

But there was definitely no sign of Armageddon or any type of ‘Blood Bath’ in sight!

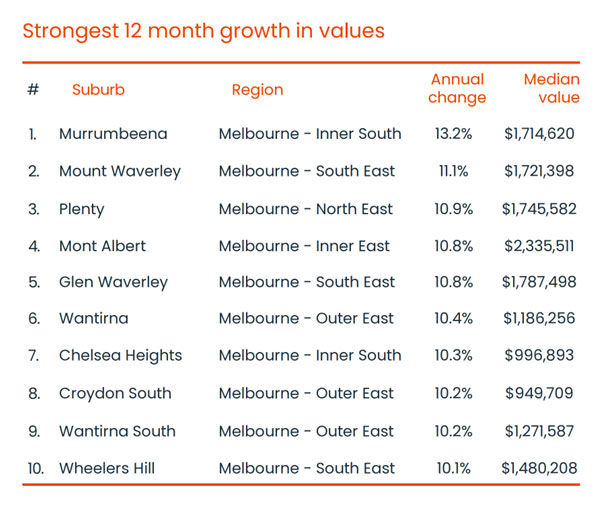

In fact, many of Melbourne’s top eastern and bayside suburbs stubbornly defied the odds, and performed quite well, with many hitting double digit growth in 2023, according the latest ‘Best of the Best’ December 2023 Report from Core Logic;

Now I don’t know about you, but I am happy with a 13.2% annual capital growth appreciation in Murrumbeena…

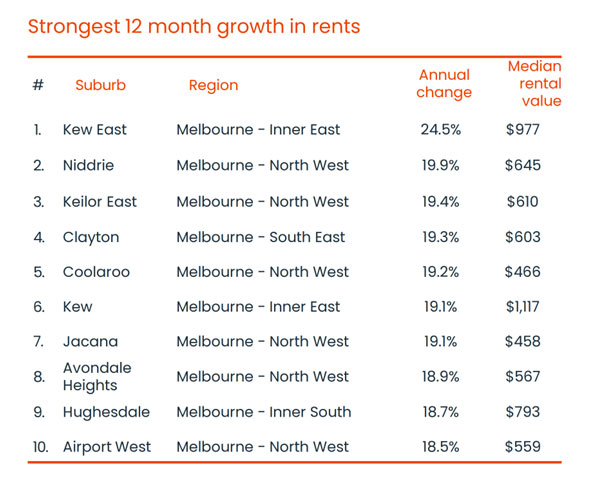

And guess what, to further negate these doomsdayers, not only did the Melbourne property market refused to crash in 2023, but rental yields surged at an unprecedented levels, in ‘Key Suburbs’, due to a chronic shortage of new stock - and over 1000 developers going bust over the last three years, as a result of the Dan Andrews imposed Covid-19 lockdowns (send him a thank you now for saving our lives from the nasty Bat virus when you get a chance!) …

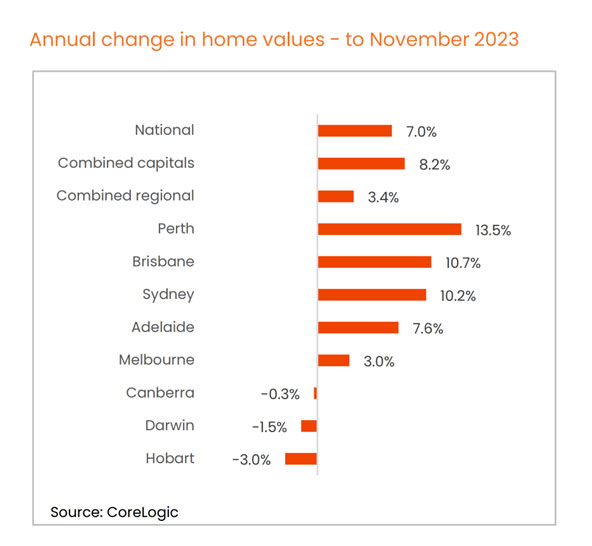

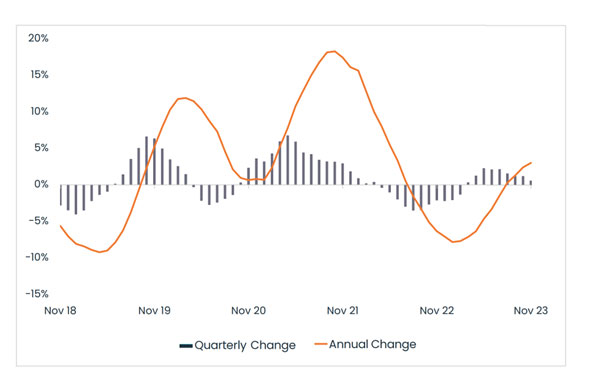

But it gets worse, much, much worse!... You see, since 2028, and during the last 7 years, when the largely uninformed media was prophesying that the bottom would fall out from the entire Australian Property Market, the opposite occurred! (how dare-it?) See the December 2024 CoreLogic figures below;

It seems that the National Housing Market in Australia appreciated 5.5% in December 2023 to December 2024!

With Reginal Areas appreciating at 6% p.a. and Major Combined Capital cities by a healthy 5.4% for the same 12-month time frame.

And for Melbourne, the latest CoreLogic data show us, what I have been already teaching on my YouTube channel and live events;

The best time to get into the Melbourne property was back at the end of 2022!

But, hey, what do I know? It’s not like I have written a book on Real Estate investing…

Wait!

Actually, I have!

The saddest part of all of this is that every-day hard-working Australians are being robbed of achieving these extraordinary results, as they end up listening to the scaremongering media and sitting on the sidelines, not taking part in the Australian Residential Property Market, which has been experiencing the biggest single property boom in the last 30 years!

House prices in Australia’s capital cities have skyrocketed by an astounding 3,435% over the past 50 years, far surpassing wage increases, according to a recent analysis by Money.com.au.

While property values surged, the median full-time wage grew only by 1,183% in the same period, highlighting a significant affordability gap for prospective homeowners.

In 1975, the median house price in major cities was four to five times the annual median wage of $6,700.

Today, however, this figure has ballooned to 12 times the current median wage of $86,070, creating a widening gulf between income and housing costs.

More specifically…

Recently, the Australian Bureau of Statistics (ABS) released dwelling approvals data suggesting that the nation’s housing shortage continues to worsen.

In the month of November 2024, 15,194 dwellings were approved for construction, roughly 25% below the Albanese government’s target of building 20,000 homes per month.

In the year to November 2024, 168,691 dwellings were approved for construction, around 71,300 (30%) below the Albanese government’s target to build 240,000 homes per month.

Alex Joiner, chief economist at IFM Investors, noted on Twitter (X) that trend approvals are currently sitting at long-term average levels, which is “not bad considering where interest rates are”.

While that is true, as illustrated above, the problem is that Australia’s population growth via net overseas migration is running way above long-term average levels.

The outlook for housing construction is poor.

Residential construction costs have risen by around 40% since the beginning of the pandemic.

Interest rates are much higher than during last decade’s construction peak.

Thousands of construction firms have gone bust, reducing capacity across the industry.

Finally, developers are competing against state government ‘big build’ infrastructure projects.

The upshot is that the supply curve for housing has effectively shifted to the left, decreasing the volumes of homes that can be built and raising their cost.

As a result, Australia’s housing shortage will inevitably grow.

In Melbourne, house prices have jumped by 3,496% over 50 years.

With a 1975 median house price of $28,700, the figure has now crossed the million-dollar threshold to reach $1,032,020, representing a twelvefold increase relative to the median wage.

The average mortgage payment went from 37% of monthly income to 91%.

And for Melbourne, the latest CoreLogic data show us, what I have been already teaching on my YouTube channel and live events;

Despite Melbourne’s property market falling in price throughout 2024, a new report predicts the city will become a prime investment location.

Hotspotting by Ryder Property Research predicts Melbourne will rebound in 2025, according to its Top 10 National Best Buys report which evaluates regions based on their infrastructure, employment, urban renewal, lifestyle, and migration factors.

“Melbourne faced challenges in 2023 and 2024, but it’s poised for a comeback next year,” says Hotspotting director Terry Ryder.

“Its price gap with Sydney and high population growth, despite high state taxes and ongoing governance issues, make it an attractive prospect,” he says.

Melbourne’s median house price is expected to grow by 3 per cent to 5 per cent and begin to play catch up, says Domain chief of research and economics Dr Nicola Powell.

“When we do get to the next property price cycle, we’re likely to see Melbourne overperform relative to other capital cities because it will go through this kind of catch-up growth phase,” she says.

“There are buyers in Melbourne at the moment who are seeing this opportunity to purchase because of that value that’s been building up over time.

“What will spark the massive return of investors for Melbourne is when we start to see better [property price] growth prospects. And those growth prospects aren’t quite there yet.”

Did I also mention that affordability is likely to improve significantly in 2025!

You see…

The major bank has come forward with its predictions for interest rate cuts, penning a total of three for 2025.

NAB Group CEO Andrew Irvine released a statement on behalf of the major bank, saying that Aussies should expect some relief after economic troubles plagued many throughout 2024.

“It’s my view that we’re at the hardest point of the economic cycle right now and things will get better from here,” Irvine said.

“We’re seeing tax cuts for Australians that most are actually saving, so deposit balances are increasing in the sector, which I think is promising. And we do expect interest rates to start to fall by the middle of this year. We’re then expecting two further cuts during the year.”

With potential interest rate cuts and a federal election expected to shake things up, 2025 is set to be a big year for Australia. NAB has recognised right now as the hardest point of economic pressure, with challenges set to ease.

“People are juggling, people are budgeting and they’re budgeting hard to make ends meet every single month,” said Irvine.

“The big thing for us is employment and the strong employment market conditions throughout Australia and the minimal amount of unemployment. Typically, in my experience, as long as people have jobs and there is income coming into the household, most bills, most mortgage payments are met, and the worst doesn’t happen.”

So, in summary, despite the ‘Doom and Gloom’ portrayed by the media, we have the following factors that make this a perfect buying opportunity for savvy, educated, and market-ready property investors;

We have record levels of foreigners coming to Melbourne to live and buy property, record high rental increases in key suburbs, combined record low vacancy rates of 1.2 percent, coupled with a low volume of current stock available for sale, some 30 percent less than the same time last year.

To further aggravate the situation, there is a record low volume of a future stock in the pipeline, as developers and builders keep shelving future projects indefinitely, due to uncertainty in the ever-escalating cost of materials, critically low number of skilled labour, and the risk associated with entering into fixed contracts for off-the-plan sales, not knowing if there is going to be any profit upon completion of new projects.

Plus, it is highly probable that we are approaching the peak of the interest rate cycle, and as soon as Australian inflation is under control, which we are close to achieving, the RBA will start to cut interest rates to their recent low levels!

This will be great news for property investors as their investment properties will soon become cash-flow neutral and then positive!

All these factors have contributed to a unique situation wherein savvy educated and market-ready investors have taken advantage of the prevailing circumstances and are going in hard, negotiating deals, and securing investment properties at the very bottom of the Melbourne property cycle…

I’ll get straight to the point…

The best time to BUY from a ‘market timing’ perspective was December 2022…

Where I picked the bottom of the Melbourne property market back in November 2022 and told everyone who listened via my YouTube Channel, Webinars, and my 2-day live events that ‘that this is it boys and girls, buy now!’

In fact, I believe, that many property investors who are currently staying out of the property market will look back retrospectively and realize that November and December 2022 were in fact the lowest and most opportune times to enter the Melbourne property market from a ‘Market Timing Perspective’…

The second-best time to buy is Now in 2024 - whilst the Melbourne property market is still subdued and trending sideways!

Don’t say 2 years from now that I didn’t tell you so…

But here is the main thing to remember, the residential property market is driven to a large extent by emotional and often irrational owner-occupiers, not investors. And these individuals don’t care where we are in the property cycle clock, or what return they are getting on their property, they are moving there for emotional reasons, i.e. jobs, children’s schools, community, etc.

Here is the unbreakable formula that determines the level of capital growth in an area;

High Capital growth is always determined by strong demand by the right demographic (high income earning), combined with scarcity of stock (i.e. St. Kilda, Elwood, Kew, Brighton, Elsternwick, Toorak etc.)

The reverse of this true for low-capital growth.

Low Capital growth is always determined by strong demand by the unfavourable (low income earning) demographic, combined with unlimited supply of stock! i.e. Point Cook, Truganina, Tairneit, Melton, Berwick, Pakenham, etc.

So what’s my prediction for the next 2 to 3 years as we enter the decline of the National Property Cycle Clock?

Well, it will be no different than the last 3 years, wherein there will be an apparent transfer effect, seeing the redistribution of wealth from the uneducated to educated property investors.

Educated property investors, who possess the right skillset, to conduct unbiased due-diligence and market research, will identify undervalued properties and snap them up…at a discount.

Conversely, uneducated individuals and newbie property investors, who lack any skills or ability to conduct unbiased due-diligence and market research, will be influenced by the largely uniformed (and predominantly broke) media commentators, who maintain that the market will crash by 40% plus and that ‘Property Armageddon’ is just around the corner.

At the end of the day, you will have to make up your own mind on the outcome of the Australian Property Market, and whether or not it is ‘safe’ to invest.

Invariably, some will go the way of Chicken Little, assuming ‘the sky [or market] is falling’, catastrophising their way to quiet desperation.

Others will proceed with caution, evaluating the true situation, recognising the excellent prospects before them.

Personally, I advise you to pause and be wary of the hysteria – it has been the source of regret for so many Australians, who, after realising their lost opportunities, have now been forced to swap their old mantra for a disheartening new one; “If only”.

So instead, do this: go out, buy a helmet, and the next time ‘The Oracle’ hollers that the sky is falling, look up, look down, and realise, it’s just an acorn.

So let me ask you a question, do you have the skills and knowledge to correctly identify the very best long term capital growth areas in Melbourne right now?

And yet despite these favourable market conditions…

That’s why so many people suffer years of grief and regret from missing out on property booms… They let fear be the dominant driver.

Follow along…

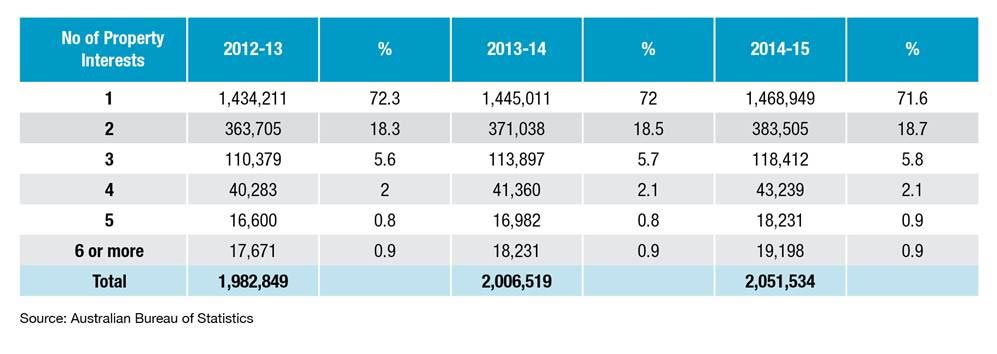

Given the Australian property market is historically one the fastest ways to become wealthy in this country, yet only a very small percentage of the home-owners have managed to buy over 6 investment properties…

Here’s proof…

According to the latest figures from the Australian Taxation Office (ATO) show that 71.6% of Australian property investors own just 1 investment property.

And most everyday investors buy in their neighbourhood… or they buy because they like the look of a property. In other words… they are emotional or sentimental reasons for buying.

Smart savvy investors don’t play that game.

We want to show you how to capture maximum capital growth with rare investor-friendly terms.

Okay, question time...

Gainsborough House

Level 1 / 8-12 Alma Rd,

St Kilda VIC 3182

Dates: 8th & 9th November

Sat Registration: 8.30 am

Sat & Sun Start: 9.00 am

Sat & Sun End: 6.30 pm

Cameron Fisher

Director Changing Places Real Estate

Stephen McClatchie

Director Loans Australia

A LIVE 2 Day interactive event that is designed to teach you the ‘Blue-Print’ of how to build and structure a multi-million-dollar property portfolio from scratch that has the potential to replace your income and eventually free you from work!

Now before we dive into how this exclusive training (and full-day bus field trip) will exactly work… Do yourself a favour and read this information carefully.

Don’t just skim over it.

This is a personal invitation from me and the team which could make a MASSIVE difference in your investing endeavours… and FAST!

First the facts:

This is not for everyone!

We can only teach 55 people, and you have to qualify via a phone call from one of our property investing consultants first.

Don’t worry… There is no prejudice towards super educated investors or anything like that… A complete rookie can qualify just as easily… But you do have to be approved first.

However, just so you have an idea of what to expect, let me unpack this out for you…

Enough talk… time to show…

Before deciding to run this 2-day event, I had to make sure I partnered up with the "Best-Of-The-Best" educators in the country.

People who not only talks the talk, but walks to walk as well!

And when it comes to knowing all the intricate elements of smart property investing, there’s a few guys who are at the top of the list – head and shoulders above anyone else…

Consisting of 2 days, over 14 hours of practical 'How To Do' content is delivered by one of Australia’s foremost Real Estate experts and professionals;

Let me introduce you to the speaker lineup;

Cameron Fisher

Director Changing Places Real Estate

View Bio »

Konrad Bobilak

Director of Investors Prime Real Estate

View Bio »

Stephen McClatchie

Director Loans Australia

View Bio »

Cameron is the Managing Director of Changing Places Real Estate and he has many qualifications that make him a top figure in the real estate market. These qualifications include: fully licensed real estate agent, qualified valuer, over 3,000 successful (and dynamic) auctions, adviser to leading Institutions, accountancy practices, and law firms.

Cameron’s services are used worldwide and his qualifications serve to demonstrate his extraordinary skill set. In this incredibly competitive industry, few can even compare to Cameron. His pioneering approach and upbeat personality make him a perfect choice for those leasing, selling or buying.

The Australian premier of "The Money Game" only offered more proof that Cameron Fisher is by far one of Australia’s elite entrepreneurs. He took on the challenge of going against Australia’s best and conquered it with surgical precision. Never was this more apparent than the challenge in which he was given $10,000 and told to turn it into as much money as he could within 55 hours. Using his impressive skill set, he turned the $10,000 into $65,466 within the 55 hours.

If you are a landlord, or buying or selling a property, then Cameron Fisher should be the only name you are thinking of.

Konrad has educated well over 120,000 Australians on how to successfully build and structure a multi-million dollar property portfolio from scratch that has the potential to replace your income and eventually free you from work!

When it comes to building a property portfolio the "RIGHT WAY" you will know you’re in the best hands. Konrad has extensive experience in Managed Funds, Risk Insurance, Real Estate Sales, Commercial Lending, Residential Lending, and Asset Finance, as well as being a Financier for one of the four major banks. In his variety of roles, working predominantly with high net worth individuals, Konrad has literally had a wealth of exposure to the unique mindset and financial structures of truly successful people and investors. It is his experience and insight that renders him a most astute investor himself, having personally built a multi-million dollar property portfolio in Melbourne and Queensland over the last decade; he truly practices what he preaches.

Konrad’s unique insights into ‘Wealth Psychology’ combined with a highly specialized knowledge of the Finance and the Real Estate Industry in Australia, have made him a sought after Real Estate and Finance ‘Key Note’ speaker and successful real estate investor. Having taught tens of thousands of people in Australia, New Zealand, and Fiji, Konrad has had the unique opportunity of sharing the stage with the likes of Sir Richard Branson, Tim Ferris, and Randi Zuckerberg in audiences of up to five thousand people. Konrad has also been a regular contributor of articles to some of Australia’s leading published real estate investing media.

As the Director of Loans Australia my vision is to create a company with the systems and structures designed to ensure that clients make the most of their finance situation to propel them forward. Having dealt with many investors and business owners with complex financing structures I understand the importance of setting up finance structures that can assist people to build a property portfolio or asset base.

I specialise in showing people the most effective ways of mortgage structuring, strategic financing, management and mortgage selection. My passion is to educate people around finance so that the knowledge and know-how of clients is enhanced over time.

Outside of my business I enjoy property investing and have developed my own property portfolio over the last 15 years. I also enjoy spending time with my family, participating in sports such as tennis and cricket, and supporting my football team.

These 2 life-changing days are split into two separate days, with each day split further into different segments. Each segment builds on the information contained in the previous session.

Here’s a closer look;

The morning session of the workshop will be dedicated to what is perhaps the most important essential ingredient in building wealth though property, being – Investor Psychology. Based on the Pareto Principle, when it comes to property investing, 80 per cent of the formula can be attributed to having cultivated the correct mindset or Investor Psychology and the other 20 per cent can be attributed to what I refer to as Specialised Knowledge.

Investor Psychology will mean different things to different people, especially when it comes to the world of property investing, given that there are so many approaches and strategies that exist in this realm of investing. Having said that, it’s worth noting that there are some commonalities linking all these investors, and their approach to property investing, and it has more to do with what belief systems they adhere to and how they do things. As Wallace D Wattles put it in his famous book ‘The Science of Getting Rich’, the rich get rich by “doing things in a certain way” not by doing ‘certain things’. In other words, it’s not what you do, it’s the way that you do it, and that’s what gets results.

One of the most important aspects of building and structuring a large residential property portfolio is to Start with the end in mind. That is, you must have an exact strategy or Blue-Print that is concise and all-encompassing before you start investing in property. Many investors get into a lot of trouble because they simply never clearly articulated and mapped out a concise strategy to begin with. Or they end up buying the wrong type of property, such as a serviced apartment in Queensland, studio apartment with living areas less than 50 square meters, or an apartment in a high density development, and most likely end up selling that property within 5 year, realising a small profit and in most cases breaking even or a loss.

The first thing that you must appreciate is that you will go through 3 distinctive stages while you are building your property portfolio;

These stages will vary from investor to investor, and will differ depending on investors personal Risk Profile, and time horizon for investing, as well as the amount of time, money or equity available.

In this segment of the event, you will gain a clear understanding of the importance of developing a personalised investment plan, based on your unique set of circumstances, and available resources.

During this segment of the event, you will also gain an understanding of the importance of creating a Master-Plan blue-print, before you do anything else. That is, your ability to clearly identify your outcome and ultimate goal for building a large residential investment property portfolio.

This segment will be the dominant one for the day, and here you will learn that Investors with the right psychology tend to use an Optimised Loan Structure, which is one that allows the property investor to have maximum flexibility and control over every single property that they control or own, either via direct ownership or via a trust/company structure. That is, each property is set up as a Stand Alone facility, that is, only one loan is taken against one property, and hence none of the properties are cross collateralised, all consisting of a variable true Line of Credit, with no mandatory repayments, and a self-capitalising component built in with the loan, preferably with separate lenders.

Furthermore, during this segment you will learn why investors with the right Investor Psychology tend to maximise the use of other people’s money, or OPM, that is, they use the maximum Loan to Value Ratio, say 95% and are comfortable paying Lenders Mortgage Insurance (LMI) as they know that the most important aspect of investing is in assessing the Return on Equity (ROE) not Return on Asset (ROA).

Finally, you will learn why most successful property investors do not own any assets in their own name, that is, they use Trusts and Corporate Trustees to Control Assets rather than to Own Assets. And the rich NEVER risk their homes. They pay for advice, surrounding themselves with successful advisors, and are themselves Financially Literate. They focus all their efforts on accumulating Growth Assets, using Good Debts, or tax deductible debts, while avoiding taking on Bad Debts or consumer credit, which has no tax advantages to secure assets that devalue over time.

“You’ve got to know your numbers!” - That’s probably one of the most common pieces of advice you’ll hear from wealthy (and RICH) property investors. - “You’ve got to know your numbers!” - And in this segment, you will learn how to calculate cash-flow analysis via Property Investor Analysis Software.

The Property Investment Analysis (PIA) Program is an essential decision making tool for all property investors. It will analyse capital growth, cash flow, and tax implications for any investment property and provide instant feedback on projected after-tax cost and rate of return. The software will compute cash flow projections for up to 40 years and has facilities for changing more than 100 variables including property price, rent, capital growth, inflation, deposit and loan type. The internal rate of return (IRR) and the cost-per-week are recalculated automatically whenever a change is made.

In this segment of the Real Estate Investing Fast-Track Weekend you will learn why your ability to use sophisticated property cash-flow analysis tools such as the Property Investment Analysis (PIA) Program will form a key determinant in your ability to succeed in the property investing game.

Time to watch it in action! At this stage you’ve learnt A TONNE of information, and now it’s time to look at how to piece it all together! In this segment of the event, you will be taken through real life examples and learn you how to use the Property Investment Analysis (PIA) Program in order to recognise the best property that you should be focusing on, based on your income tax bracket, cash flow, negative gearing benefits, depreciation schedules of different properties, debt service ratios, and the cost associated of holding different types of property.

This unique segment of the workshop is designed to create an open learning environment where you’ll walk away with specific knowledge of knowing exactly which type of property is best for you. Most novice investors find this segment of the event invaluable.

Now we’re REALLY rolling up the sleeves. They say, “You’ll make your money in property when you BUY!” Meaning, if you buy right, the potential financial windfall could be enormous for you – however, if you buy at the wrong time or without proper due-diligence, you could be sitting on a lemon for a number of years! It all comes down to the RESEARCH!

So…In the final segment you’ll learn a step-by-step and exact methodology that is currently being used by successful property investors in order to scrutinise various property opportunities. Once you understand the process of conducting unbiased fundamental due-diligence the options for investment and suburbs of choice will dramatically reduce. This section in itself is literally invaluable, as you will learn how to discern between good and bad investment opportunities like a seasoned pro, it’s actually worth coming to this live event just for this section alone.

In this final segment for the day, you will learn the importance and implication of an investor’s depth of knowledge of their chosen area of property investing and the impact of this when it comes down to their level of success. Whether it’s property options, property development, subdivisions, buy and hold, flipping or renovations, the ultimate success will lie in the investor’s ‘grasp’ of the technical aspects of their strategy, in a given area of property, together with their detail and due-diligence or feasibility studies leading up to the deal.

The important aspect to appreciate here is that there is an immeasurable difference between knowing the talk and walking the talk. There are literally thousands of academics and theorists out there who possess the basic knowledge of the how to structure and execute the deal, but very few who actually implement the strategies. The difference lies in their lack of Investors Psychology – that crucial element of the equation that actually makes the investor take action. Without the why, the how is irrelevant, as there is no execution, hence the investor doesn’t make any money.

In essence, knowledge is not power, as knowledge without action does not equate to tangible results and money.

Which brings us to the most exciting part of the event, day 2, the live Bus Property Due-Diligence Field trip.

If the answer is an astounding ‘Yes’, then Day 2 of the Real Estate Investing Fast-Track Weekend is designed to help you gain the skill and awareness of how to conduct unbiased due-diligence on suburbs in Melbourne which will enable you to take your investing to the next level.

So here is the thing…

The most important aspects of buying an investment property is the future capital growth potential component, followed by rental income, and finally the tax benefits associated with the property.

When choosing a suitable investment property, care must be taken to make sure the property passes strict due-diligence selection criteria based on the principles which enable investors to identify properties that have a good chance of delivering consistent capital growth performance.

If we take Melbourne as an example, certain inner city suburbs in key areas have consistently outperformed other areas over a long period of time, in terms of capital growth.

As can be seen by the map below, based on the sales history of Melbourne suburbs sourced from the Valuer’s General Office, not all suburbs in Melbourne (within the 10km or 20km) performed equally between the period of 1986 to 2006.

Current data from the Real Estate Institute of Australia (REIA), and the Australian Bureau of Statistics (ABS) shows, despite the volatility of the European and US markets, Australian residential property in all the major capital cities has demonstrated a level of resilience that has managed to defy the expectations of the “doom and gloomers” for over three decades.

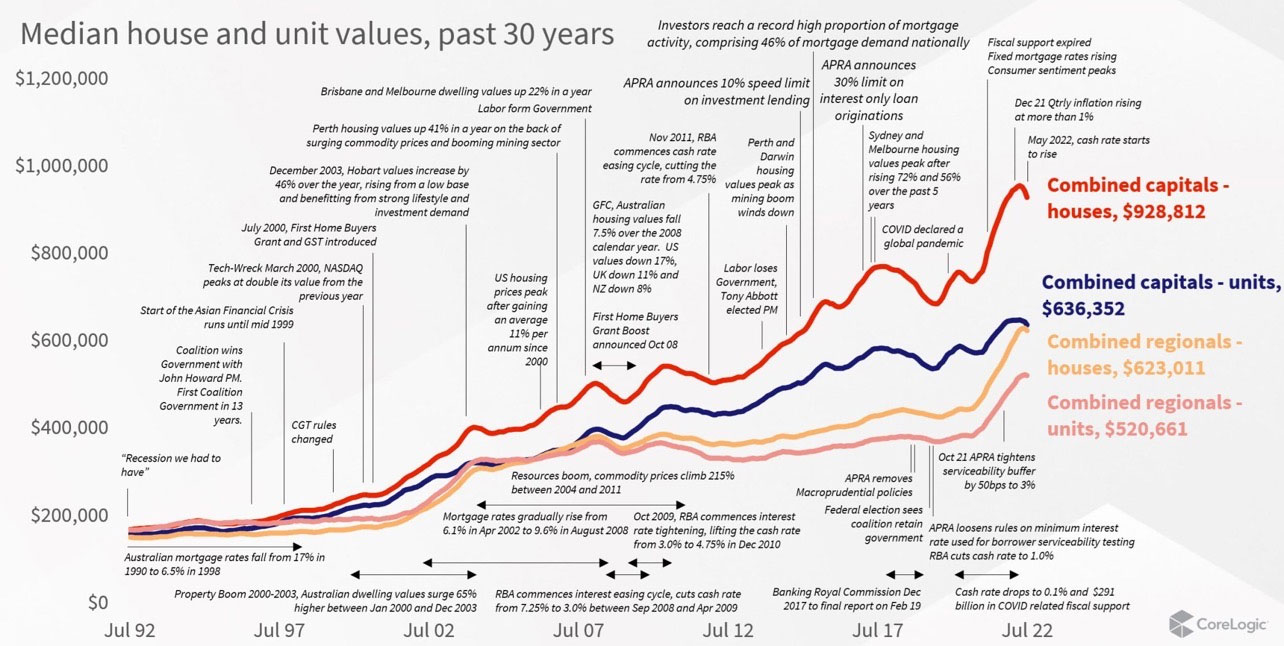

The table below from CoreLogic Australia depicts median house and unit values for the past 30 years, across the major capital cities in Australia.

Despite the recent international stock market volatility, and the crypto-currency meltdown, according to CoreLogic Australia, median house and unit values for the past 30 years have increased by a staggering 382 percent.

This can be further broken down into an increase of 453 percent capital growth for houses, and an increase of 307 percent for capital growth for units.

But despite the median price rises over the long-term, there have been a number of market corrections and negative growth in the short term, given the cyclical nature of the Australian property market. In fact, CoreLogic Australia has found that there have been six cycles of growth and decline between the years 1992 and 2022.

Hence, it is important to stress that there is a level of market volatility in the property market as well, and it is important to stress that property investing has always been looked at as a long-term investment horizon rather than a short-term one.

It’s hard to imagine strong house price growth at a time when real estate values are falling in most capital cities, but the numbers tell a different story.

One of property’s most popular sayings, that house prices double every 10 years, is more accurate than you might think.

Despite real estate values falling this year in most cities, a MoneysaverHQ analysis of 40 years of Real Estate Institute of Australia data has found that a majority of state capitals have indeed doubled every decade.

But it hasn’t been a smooth ride, often marked by many years of little growth and then short boom periods.

Since the REIA data series began in 1980, the numbers have been impressive:

Hobart’s median house price has climbed from $88,000 to $502,800 since 1991, and Darwin is up from $87,500 to $493,800 since 1987.

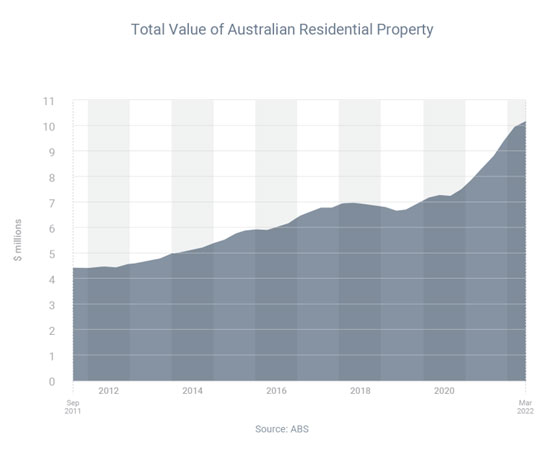

This has been evident in the latest released data from the Australian Bureau of Statistics (ABS) showing the combined value of all residential properties in Australia has passed the $10 trillion dollar mark for the first time in history, to a new high of $10.2 trillion in the March 2022 quarter.

And interestingly enough, what no one mentions in the media, is that this increase to $10.2 trillion came from a low of $5.1 trillion in 2014, meaning that our market has doubled in value in less than 7 years!

The suburb has had capital growth of at least 10 per cent over the last 10 years (RP Data)

The suburb has experienced low vacancy rates of 2.5 per cent or less (REIV)

The property is located close to the CBD, infrastructure, transport, shops, and schools

The property has a land component representing at least 50% of the value of the property (Based on Bank Valuation)

Chances are if your property ticks the above 6 points, you are on the right track, however, there are still many more due-diligence points that you will learn about during the second day of this amazing event.

Gainsborough House

Level 1 / 8-12 Alma Rd,

St Kilda VIC 3182

Dates: 8th & 9th November

Sat Registration: 8.30 am

Sat & Sun Start: 9.00 am

Sat & Sun End: 6.30 pm

Cameron Fisher

Director Changing Places Real Estate

Stephen McClatchie

Director Loans Australia

Glad you asked…

Originally, the 2 Day Real Estate Investing Fast-Track Weekend was to be made available for $1,995.00, considering the top level education and mentoring involved…

Even at that price, it’s an absolute bargain in anyone’s language – and worth every cent!

Not to mention, many people have paid TWICE that much for similar events with other companies.

In fact, if we look at the ROI (Return on Investment) you could make by putting this training into action, it could EASILY be worth $20,000 in the short term, and more than likely, hundreds of thousands of dollars (maybe even millions) over a lifetime… So we could easily charge $2,000 or even $5,000 for this truly life-changing education, and you’ll still be laughing all the way to the bank.

However…

Our intension isn’t to make it as easy as possible for you to enter this exciting world of property investing. So in a temporary moment of, some would say, insanity! – We’re letting you attend for $47!

And get this…

So what’s included in your ticket?

Well, apart from the million-dollar hands-on intimate training, and first-class bus tour, you’ll also get a FREE Hard copy of my book ‘Australian Real Estate Investing Made Simple’ valued at $39.95 plus a complimentary personalised property investment strategy session by one of our senior property consultants valued at $297.

Still sitting on the fence?

Okay, I’m going to attempt to take every single excuse away from you…

Especially the money excuse.

So, here’s the deal…

If after the end of DAY 1 you don’t feel you got your money’s worth, then let us know at the end of the day, and I will happily reach into my pocket and give you $47 cash – as a way of saying sorry that you felt we wasted your time, and you can keep a copy of the book as well.

I've done so many of these types of events that I've lost count – and there has NEVER been anyone EVER ask for their money back –

That’s how good this is!

So click on the link below right now to see if you qualify to be one of the exclusive 55 investors who join us on this incredible 2-Day experience…

Gainsborough House

Level 1 / 8-12 Alma Rd,

St Kilda VIC 3182

Dates: 8th & 9th November

Sat Registration: 8.30 am

Sat & Sun Start: 9.00 am

Sat & Sun End: 6.30 pm

Cameron Fisher

Director Changing Places Real Estate

Stephen McClatchie

Director Loans Australia

You are wanting to understand the very best loans that are available for you and how to best structure your finances in order to repay your home in record time, often in under 10 years. During this event you will learn why it’s crucial to set up the correct loan structures before you buy your very first investment property, and how to use the banks money at no cost in order to reduce the amount of interest that is being charged on your home loan.

This will cut years off your home loan and save you tens of thousands of dollars in interest payments over the life of the loan. You will also learn how to build equity in your property faster than you thought possible, and how to best structure your first investment property purchase correctly.

And you're wanting to buy your very first investment property, and are unsure on how to best structure your loans.

During this event you will learn the best way to optimise your property portfolio structure from day one, revealing many little known loan structuring techniques that maximise your borrowing capacity, whilst maximising flexibility, future access to equity, as well as being tax effective and minimising risk.

And have secured between 1 and 5 investment properties, but have hit a financial ‘brick wall’ and are maxed out, or just unsure of how to go to the next level of sophistication.

During this event you will learn how to beat the banks at their own game by understanding the ‘exact formulas’ that the banks use to work out how much money you can borrow, the Debt Servicing Ratio (DSR).

Let me remind you of the URGENCY here…

This page will be seen by over 11,000 aspiring investors who are equally as keen and motivated as you…

However, we have space for 55 people ONLY – You’d better respond quick, or there’s a very high risk you’ll miss out.

This is strictly a first-in-first served basis, so if you want get a head start on all the other THOUSANDS of property investors out there, then click the button below to see if you qualify…

What I must warn you about is the dangerous emotional cancer of procrastination. I find when somebody knows that “x” is the right thing to do but requires them doing something out of the ordinary, they play a game with themselves…. they set everything aside to “think it over” or take care of “a little later”. Beware!!

I’ll tell you something, successful entrepreneurs do NOT engage in these mind games and delays.

“Action” is the key my friend…

I hope you choose to do the right thing for yourself and your family… and that your future becomes all that you want it to be and MORE!

And just imagine…in the near future, instead of getting up early and battling the traffic, you wake up when you feel like it, with a smile on your face because you know that you have achieved financial independence through your property portfolio…

Commit to making it work knowing that you’ll be backed by the best education available and the best team of qualified experts cheering for you and encouraging you to succeed the whole way! This 2-day Real Estate Investing Fast-Track Weekend will be nothing short of life changing for the lucky 55 qualifiers…

Looking forward to meeting you on the weekend…

To your success,

P.S. This is possibly the best (and smartest) way for you to quickly take advantage of Australia’s Property Investing market and discover everything you need to know to grow a successful property portfolio fast!

P.P.S. You’ll get THOUSANDS of dollars of REAL WORLD value and experience over this weekend - learning from some of Australia’s elite educators - PLUS a spectacular “fly-on-the-wall” experience on Day 2 where you can look-over-the-shoulder of a LIVE property assessment and due-diligence! - Be sure to click the button and reserve your spot today!

P.P.P.S. Remember… SPOTS ARE LIMITED TO 55 Investors ONLY! This is strictly on a first-in-first-served basis, so book your place now to avoid missing out.

Gainsborough House

Level 1 / 8-12 Alma Rd,

St Kilda VIC 3182

Dates: 8th & 9th November 2025

Sat Registration: 8.30 am

Sat & Sun Start: 9.00 am

Sat & Sun End: 6.30 pm

The Workshop was brilliant! The amount of information I got I think I can quite easily save about 200k just from knowing what I’ve learnt today, I think that’s why everyone has to go.

What key ideas and strategies did I learn from the workshop? top one was interest only loans and how you can repay your mortgage in 10 years, and in some cases under 2 years.

The other one was structuring your trusts to minimize your risk and the amount of tax you pay and the final one was actually how to buy property without spending any money, it was brilliant.

~ Pradyumna, Mooroolbark, VIC

Jenny – We’ve really enjoyed the day, it’s been really illustrative of what’s available and there’s some good quality properties and the knowledge has been tremendous coming from the team, Konrad, Craig and yourself and also Stephen McClatchie.

Fred– We certainly thought there were some very good ideas about how we could invest out money and make quite a lot out of property, hopefully in the future.

Jenny – So it’s good to see, interesting to see an entrance in the market so looking at the forward 500 thousand dollar up to 600 thousand dollar properties which is great, so that’s a good entrance area that is doable for us and I guess doable for the other people here, so it’s a great way to start and it’s nice to have your hand held by people who’ve been there and done that and had a lot of experience that they’ve had and want to share that so it’s been great. Thank you.

~ Jenny & Fred, Mount Waverly VIC

Hi my name is Greta Lilley, I’m semi-retired and I used to own a big design company, I do have a few investment properties but there is always more to learn. One of the messages today was “you don’t know what you don’t know” and in different stages of your life you have to keep reviewing things and that is why I am here today.

The information that you get at this seminar is absolutely priceless and if you follow the formula you can’t lose.

It’s a risk free way of doing things really if you follow the formula. You have to be set up and if you are set up you have to have the right team and this is what give you access to the right people. I’ve tried to get the right people together on my own and it’s really difficult to find lawyers and accountants who understand the whole process.

~ Greta, Melbourne, VIC

Hi my names Gagan from Cragieburn and it was a big pleasure to see you guys very professional helping us to start investing in properties and stuff and I already feel confident that we are as a first home buyer and stuff you know we have not much knowledge but after attending two days session I feel more confident and I know I’m around good people and a good team.

~ Gagan, Cragieburn, VIC

Hi my name is Tamara, I’m from Ivanhoe, Melbourne, Victoria and I attended the event and I found it really helpful. Mostly it is geared at people who are looking to get started with the Fast Track system that’s is getting you towards an investing position and most of the strategies were quite invaluable.

For something that is free of cost, it is an unbelievable investment. Yes I would recommend it and I already have recommended it to several people.

~ Tamara O’Dowd, Ivanhoe, Accountant

Hi my name is Michael, I am a carpenter who’s looking to get out of the building industry and I’m from Glen Waverly. I wanted to get out of the construction industry and I have a passion for finance, I'm wanting to get into the finance industry and my partner bought Konrad’s book online and as a result of her interaction with him I got a ticket to come to the event today.

(The Workshop) was a brilliant use of time, a lot of strategies I’m just starting to realize that maybe not having a lot of money in your bank account, you can still own property if you follow the key strategies that were provided in todays seminar. For me it was about the strategy and realising about the power of leverage. I guess for me it was from my background from my parents I was always told to get the 30 year mortgage and now I’m realising that there are other avenues that can open up the market and accelerate your growth and expansion, very interesting stuff.

I would recommend this to anyone who has a keen interest in property.

~ Michael, Glen Waverley, VIC

My name is Kristina and I’m from East St Kilda, I’ve been involved in this programme for this weekend and it’s been very exciting for everyone, very informative and very initiative for the average person.

This property finance seminar has been very very informative for the average person it opens up many opportunities, especially the concept of owning property with very little up front contribution and the prospect of looking forward to your retirement with you having accumulated quite a number of properties to finance your retirement, that’s probably what was most appealing to me.

I would absolutely recommend this program to everyone out there, absolutely.

~ Kristina, East St Kilda VIC

Hi my names Wes, I’m from Narrie Warren South, Berrick Springs, the day today has been really good, it’s been a lot more relaxing than yesterday. Yesterday we took in a hell of a lot of knowledge and it’s definitely changed my thought on property investment that’s for sure.

I’ve already started with my first property and realised that I’ve done everything wrong so now I have to change all my structures and figure it all out.

That’s about it from me, it’s been a great day, enjoyed today as well.

~ Wes, Narrie Warren South, VIC

My name is Mick, I’m from Beaumuris, very informative weekend, has sort of opened up a whole different mindset for me, my wife, my kids for financial freedom for the future.

I think anyone who wants to get serious about a better lifestyle maybe not for themselves but for their kids, absolutely.

~ Mick, Beaumaris, VIC

Hi, my name is Beata, I’m from Wyndam Vale, I came on to this event without realising how much I didn’t know about investing properly and I’ve learnt so much more I’ve leant how to maximise the money you borrow and I’ve learnt how to make that money work for you to buy other properties.

I would defiantly recommend somebody else to come and attend this, in fact I’m going to try and drag all the people I know to come and attend it because, you don’t know what you don’t know until you know!

~ Beata, Wyndam Vale VI

Hi, my names Ray and I’m from Fitzroy, I’m a full time property investor and I’ve just been to a 2 day property information weekend which I found extremely rewarding and what I got out of it was that even though I have been full time property investing for 15 years, there are strategies that I haven’t been following and I realize to be more successful in what I’m doing like a ‘Nadal’ or a ‘Federer’ who all have coaches, I need to get a coach or a mentor as well.

I believe I have found the right people to be my mentor so that I can take it to the next level so I would definitely recommend this program to anybody who is looking at getting involved in property investment and anybody who is looking at creating long term wealth and subsequently financial freedom.

~ Ray, Fitzroy VIC

Hi guys, my names Serita and I’m from New Zealand, I have currently moved to Melbourne. What can I say about the course, incredible. The amount of information you will learn is mind blowing. I sat there and in was writing everything down and then to be told afterwards that I was going to be getting a USB with all the information already on it, I was like thank god! Because the amount of seminars I’ve gone to and missed information is just you know, too much information was lost to be able to be told I would have that and able to take it home was incredible.

The team here are very genuine, they want to help you. I felt looked after the whole weekend, I would be able to take away all the information and the USB stick and come tomorrow which is Monday, I’m going to hit it hard, I’m going to go over all my notes. Konrad gave us his free book, I’m going to go over all my notes then meet up with the team and start getting to get my own A team and the A team will all be all Konrad’s team.

So what more can I say, you’ve got to come, it’s the best 2 days I’ve spent in probably a good few years and the most laughs I had as well because the people that who come are very like-minded and are very happy and positive so it’s a good environment to be in, you won’t be disappointed.

~ Serita, Melbourne, VIC

My name’s Ian, I live in East Hawthorn, I’ve spent the weekend here at this seminar and I thought it was fantastic. I really really enjoyed the presentation by Steve McClatchie on finance, very very good and I recommend anyone to come to this presentation for a weekend because you’ll thoroughly enjoy it, especially if you are interested in real estate. It was brilliant.

Thank you.

My name is Julie, I’m an accountant, and I’m from Keysborough, South East Melbourne. I’m a beginner level investor in property and I think that this 2 days weekend is very worth the time investing and has changed my perspective in investing in properties and I would highly recommend it to anyone who is interested in property investing.

~ Julie, Keysborough VIC

Interested in learning more about property investing in Australia? Please visit our main website InvestorsPrime.com.au for loads of free resources, articles, videos and more to help you on your investing journey.